Tobacco and alcohol have been taxed, as an incentive to reduce consumption, but what about the likes of red and processed meat? The World Health Organisation already define red meat as being ‘probably’ carcinogenic and they rank processed meat in the highest class of carcinogens, along with asbestos, etc.

A recent Oxford University study 1 looked into how much tax would be needed in order to offset healthcare costs specifically related to the eating of red and processed meat.

So by what percentage do you think they calculated that red meat should be increased? 100%? 50% No, a mere 14%.

And, processed meat? Surely this should be at least doubled in price, being that it’s so ridiculously cheap already. Well, they did estimate that it needs to be increased by 79%.

Blog Contents

Study findings

They reckon the saving would be 6,000 annual deaths and a cost saving for the NHS of around £1 billion a year.

The cost implication would result in an average pack of sausages rising from £2.50 to £4.47, and a fillet steak from £5.50 to £6.27.

The researchers looked at global consumption of red and processed meat and their estimates of the impact of increased taxation varied from country to country, of course. However, overall they estimated that the health-related costs to society that would be attributable to red and processed meat consumption in 2020 would amount to $285 billion, three quarters of which were due to processed meat consumption.

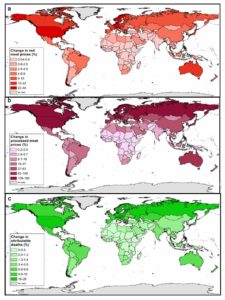

The following charts show the global impact of increased taxation on red meat (a), processed meat (b), and the resulting changes in deaths attributable to the predicated subsequent reduction in their consumption (c).

Study conclusion

“Including the social health cost of red and processed meat consumption in the price of red and processed meat could lead to significant health and environmental benefits, in particular in high and middle-income countries.”

Final thoughts

I suspect that, as with most addictive substances, whether it be tobacco, alcohol, cocaine or salty/fatty animal foods, there will always be those who are willing to pay a higher price so that they can get their fix.

However, if a government is to use taxation as a means of dissuading at least some of their (less-wealthy?) citizens from indulging in unhealthy substances, it makes sense that they should apply it to foods (and drinks) that are known to both cause harm to one’s health and shorten one’s life expectancy.

The question remains, though: when these animal and processed foods have been known for so long to cause considerable harm, why haven’t governments been imposing high taxation for years, if not for decades?

References

- PLoS One. 2018 Nov 6;13(11):e0204139. doi: 10.1371/journal.pone.0204139. eCollection 2018. Health-motivated taxes on red and processed meat: A modelling study on optimal tax levels and associated health impacts. Springmann M, Mason-D’Croz D, Robinson S, Wiebe K, Godfray HCJ, Rayner M, Scarborough P. [↩]